Contents:

Create and share a professional summary of finances and business data with your business partners. Tailor your reports to the info that matters most, and keep your accountant in the loop with real-time email updates. Sync employee time to QuickBooks Online seamlessly and in real-time. Track time against specific jobs/customers, on any device, for timesheets that are accurate to the minute. With Tsheets by QuickBooks, your time data will automatically flow to QuickBooks. Sales tax calculation rules tend to vary from one state to another.

The software comes in different versions to suit various applications. You may experience occasional navigational difficulties, and the software has a semi-steep learning curve compared to its locally installed counterparts. You may find lengthy support waits frustrating if you need help. QuickBooks Online may be the ideal choice for businesses that want lots of features in easy-to-use, cloud-based software.

How Much Does Restaurants Accounting Software Cost?

Instead, you’ll need to contact the company for custom pricing based on your specific needs. Pricing for Restaurant365 is broken down into tiers and starts at $399 per location per month and goes up to $489 per location per month. Both the Core Operations Plan and the Core Accounting Plan are $289 per month and are primarily focused on operating or accounting aspects of the business. Plate IQ can be your drop-in solution for easily going from an invoice to bill pay.

Intuit QuickBooks accounting solution may be deployed over the cloud or on-premise. In either case, you will have several price plans to choose from for your needs. The QuickBooks option is suitable for small sole proprietors, partnerships, and restaurant corporations. Adding customer information and offering discounts can be done directly at thin e POS, saving you a great deal of time when it comes to accounting for discounts and other expenses. Record payments and pay bills on time with our recurring payments functionality. From table side ordering systems, employee management and income and expense tracking, we have you covered with apps that talk directly to one another.

Book a free product tour

Add multiple users – Need your bookkeeper, partner, or other employees to have access to your ZipBooks account? Add as many users are you need to for maximum cross-collaboration. Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business. It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more.

MarketMan passes all line item details from an invoice into the corresponding general ledger codes in Quickbooks. All of these disparate functions can be tracked and catalogued automatically through the integration, saving you countless hours every week recording and uploading expenses. Although accounts payable seems like an easy part of the restaurant accounting system I have learned a few things from past experiences.

Best for Paying Sales Tax

To get a free 30-https://bookkeeping-reviews.com/ no-commitment trial plus access to the full video training library. As I mentioned earlier this is a poor procedure that can cost you a lot of money. Once the bill has been entered the person entering the bills should then file these away in either an electronic filing system or an older style filing cabinet. One thing I would address before anything else is what your bookkeeping needs are and who should be involved with the process. I will work alongside you to complete the project on schedule and in within budget.

Intelligence Full suite of reports and insights to keep you on track. Call on your dedicated team for expert assistance and access to 24/7 premium product support via phone and live chat. Create custom fields to easily search, sort, and filter business data, and build customized dashboards to track what matters most. Make informed business decisions and get the insights you need most with customizable, presentation-ready reports.

We are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in real-time. You can even get the benefits of anytime availability of Premium support for all your issues. XLS, XLXS, etc., are supported file formats by Dancing Numbers.

How to Set Up Deferred Revenue in QuickBooks

All of these events spotlight can be logged and managed through MarketMan, and thus fed into Quickbooks. This provides automatic W-2 electronic filing at year’s end, free direct payment, tracking and reporting of workers’ compensation, and tax calculations. All package levels of QuickBooks also include payroll processing, however, there is an additional monthly fee for this service. The dashboard provides a summary of the company’s sales, receivables, profit and loss, expenses, and invoices. Real estate agents and managers need specialized accounting tools and features to help them collect payments from… You and your staff will also benefit from self-paced online training resources, which are valued at $3,000.

Gain even more insight by viewing built-in bookkeeping reports that compare performance between periods. Quickly access a profit and loss report that shows how much of each sales dollar you spend on each expense category. QuickBooks has the reports you need to quickly make smart decisions for your restaurant. No more having to deal with paper invoices and manual data entry.

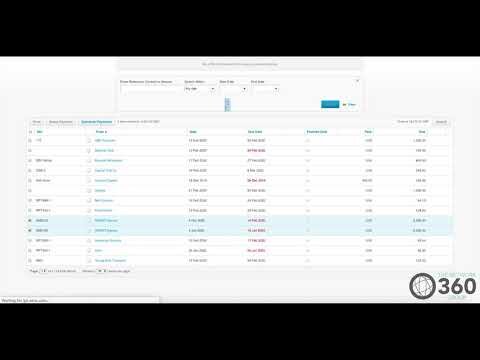

The simple AP feature in QuickBooks is an excellent entry-level option for restaurants that only need to know which customers and vendors they owe money to. You can automate and manage orders and inventory management with QuickBooks. With around 80% of the market share, QuickBooks is by far the most popular software for accounting for restaurants. Run payroll quickly and accurately by integrating time and attendance data directly with QuickBooks Online. Make the right decisions for your business with sales reports that are easy to read and use.

QuickBooks’s P&L report can be run monthly, quarterly, or annually to get a snapshot of your restaurant’s overall net income, expenses, and profitability. Added security and more in-depth accounting features — particularly in the area of reporting. Additional applications can be plugged in to QBO to assist with tasks like tracking inventory, timecards, and payment acceptance. And if you’re looking for a new POS or inventory app designed specifically for restaurants, you can choose from 50+ apps that work seamlessly with QuickBooks.

Inventory Tracking & Order Management

I would then have remote access set up where multiple people can log into the server and QuickBooks at the same time without interfering with one another. There are still many modifications and suggestions I will make on a proper QuickBooks setup and bookkeeping procedures for a restaurant. After trying multiple platforms, ZipBooks proves to surpass all expectations. Would recommend a thousand times over because it has been crucial to my business growth.

QuickBooks does not automatically integrate with major POS systems. However, xtraCHEF provides the missing piece for QuickBooks andToast users! Sync, a premium feature from xtraCHEF, sends sales data from Toast directly to QuickBooks to create automatic journal entries. QuickBooks is one of the largest cloud-based accounting systems in the world with over 4 Million businesses utilizing their software. QuickBooks is commonly used by small businesses, especially restaurants.

If you are going to add various locations you need to make sure that your payroll service provider can give you that data broken down by location. You especially want to make sure they can accommodate QuickBooks class tracking in their payroll import. Restaurant Owners – I would suggest that restaurant owners be the only people that have the ability to sign checks, pay bills or move money in anyway. Personal coaching and training is performed remotely or on-site.

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

It is very convenient to run the profit and loss reports, evaluate the performance and make the necessary adjustment by setting up QuickBooks for Restaurants. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

QuickBooks allows you to automate and oversee inventory and order management. When you first set up QuickBooks, you can tailor it specifically to the needs of your restaurant. Knowing its core benefits can help you decide how QB can help your restaurant’s finances run successfully.

Companies such as ADP, Infinisource and Paychex all do a good job. If there is ever a discrepancy or audit the bill in question can be easily found. Under no circumstances should anyone but an owner have the ability to sign checks, pay bills or move money.

Differently abled people learn job skills at The Hive, a café in Willard … – Restaurant Hospitality

Differently abled people learn job skills at The Hive, a café in Willard ….

Posted: Mon, 19 Sep 2022 07:00:00 GMT [source]

However, if you set up your company file using the easy start interview there is an option to select the restaurant industry. QuickBooks will then make suggestions based on your industry to set up the software geared towards a restaurant. ($129) This Library of 20 customized Microsoft Excel Spreadsheets is designed specifically for foodservice applications!

Leave a Reply